The Ichimoku Cloud Cheat Sheet: Advanced Tips for Trading NZD/USD Like a Pro

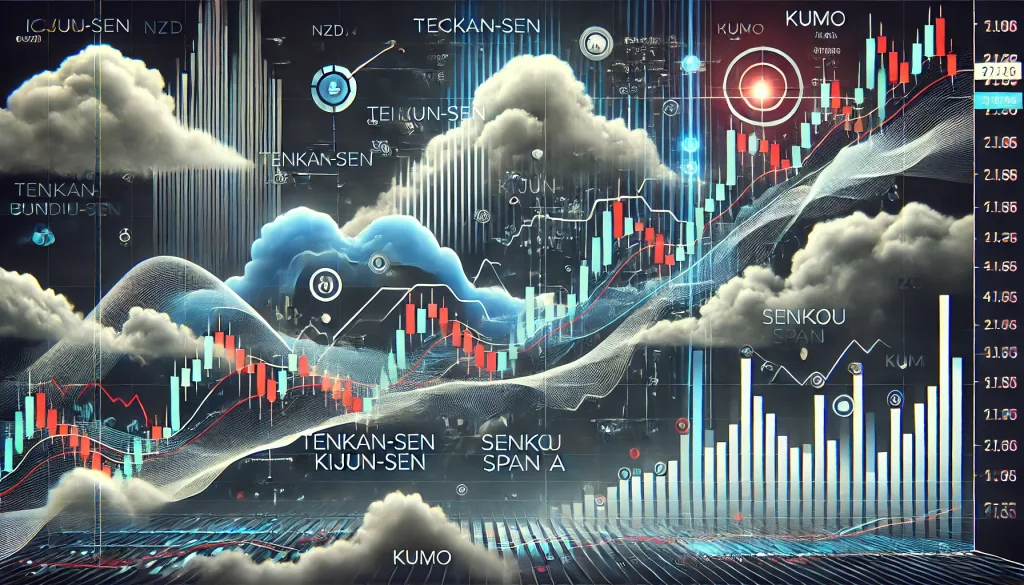

Navigating the Forex market with finesse requires more than just basic tools—it demands mastery of strategies that others overlook. Enter the Ichimoku Cloud, a comprehensive indicator that provides a panoramic view of market trends, momentum, and potential reversals. Today, we’re diving deep into how to leverage the Ichimoku Cloud specifically for trading NZD/USD, uncovering hidden patterns and insider tactics that can elevate your trading game.

What is the Ichimoku Cloud, and Why Should NZD/USD Traders Care?

Think of the Ichimoku Cloud as the Swiss Army knife of technical indicators. It’s not just about identifying trends; it’s about anticipating them. With five key components—Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span—it provides traders with a holistic market view. For NZD/USD, which often reacts to macroeconomic news and global risk sentiment, the Ichimoku Cloud can be a game-changer.

Quick Tip: NZD/USD is known for its volatility during Asian and U.S. trading sessions. Pairing Ichimoku insights with session-specific strategies can significantly enhance your edge.

The Secret Sauce: Ichimoku Cloud Hacks for NZD/USD

- Decoding the Cloud: Finding Your Sweet Spot

- Kumo Breakouts: A Kumo (cloud) breakout often signals strong bullish or bearish momentum. For NZD/USD, pay attention to the width of the cloud; a thin cloud suggests weaker support or resistance, while a thick cloud indicates robust levels.

- Hidden Opportunity: When the price hovers around a thin cloud, it’s like finding a loose Jenga block—a breakout is imminent. Combine this with volume analysis for confirmation.

- Mastering Tenkan-Sen and Kijun-Sen Crossovers

- The Tenkan-sen (conversion line) crossing above the Kijun-sen (base line) is a classic bullish signal, and vice versa for bearish moves.

- Pro Tip: Backtest crossovers during high-impact news releases, such as New Zealand’s GDP announcements or U.S. nonfarm payroll data. You’ll notice patterns that can be exploited for quick gains.

- Chikou Span Magic: The Overlooked Indicator

- The Chikou Span (lagging line) can confirm trend strength. If it’s above the price—bingo, the bulls are in charge. Below? Bears are growling.

- Ninja Trick: Use the Chikou Span to validate breakouts. If the line aligns with a support or resistance level, it’s like a second opinion from a market veteran.

Debunking Common Myths About Ichimoku Cloud

Myth #1: The Cloud is Too Complicated Truth: It’s only complex if you try to use all components at once. Start by mastering one element, like Kumo breakouts, and gradually integrate others.

Myth #2: It Doesn’t Work on NZD/USD Truth: The Ichimoku Cloud adapts beautifully to NZD/USD’s behavior, especially during periods of economic divergence between New Zealand and the U.S. Just ensure your settings align with the pair’s volatility.

Myth #3: It’s Not for Short-Term Trading Truth: While Ichimoku is often used for swing trading, adjusting the parameters (e.g., 6-13-26 instead of the standard 9-26-52) can make it a scalper’s best friend.

Advanced Ichimoku Cloud Strategies for NZD/USD

- Cloud Twists: The Hidden Reversal Signal

- A twist occurs when Senkou Span A crosses Senkou Span B, flipping the cloud’s color. This often precedes a trend reversal.

- Case Study: In December 2024, a cloud twist on NZD/USD’s daily chart coincided with a reversal from 0.6200 to 0.6450, delivering a 250-pip rally.

- Multi-Timeframe Analysis

- Use the Ichimoku Cloud on multiple timeframes to confirm trends. For instance, align a bullish signal on the 4-hour chart with a supportive daily chart trend.

- Insider Tip: If the daily chart shows a thick bullish cloud, focus on long trades on shorter timeframes to ride the macro trend.

- Fibonacci Meets Ichimoku

- Combine Ichimoku signals with Fibonacci retracements for precise entry points. For example, if the price pulls back to the 38.2% Fib level and hovers near the Kijun-sen, it’s often a low-risk entry.

Avoiding Common Pitfalls

- Ignoring Fundamental Context

- NZD/USD’s movements are heavily influenced by dairy prices, risk sentiment, and Fed decisions. Always consider the bigger picture.

- Overloading Your Charts

- Simplicity wins. Use Ichimoku as your primary tool and supplement it with one or two complementary indicators, like RSI or MACD.

- Chasing Every Signal

- Not every crossover or breakout is tradable. Filter signals using volume, trend strength, and higher timeframes.

Wrap-Up: Trade Smarter, Not Harder

The Ichimoku Cloud isn’t just an indicator; it’s a trading philosophy. By mastering its nuances and applying these advanced strategies, you can unlock hidden opportunities in the NZD/USD market. Remember, it’s not about predicting the future but preparing for it.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The