Mastering USDCAD: The Bullish Pennant Playbook

The Secret Sauce to Trading USDCAD’s Bullish Pennant Like a Pro

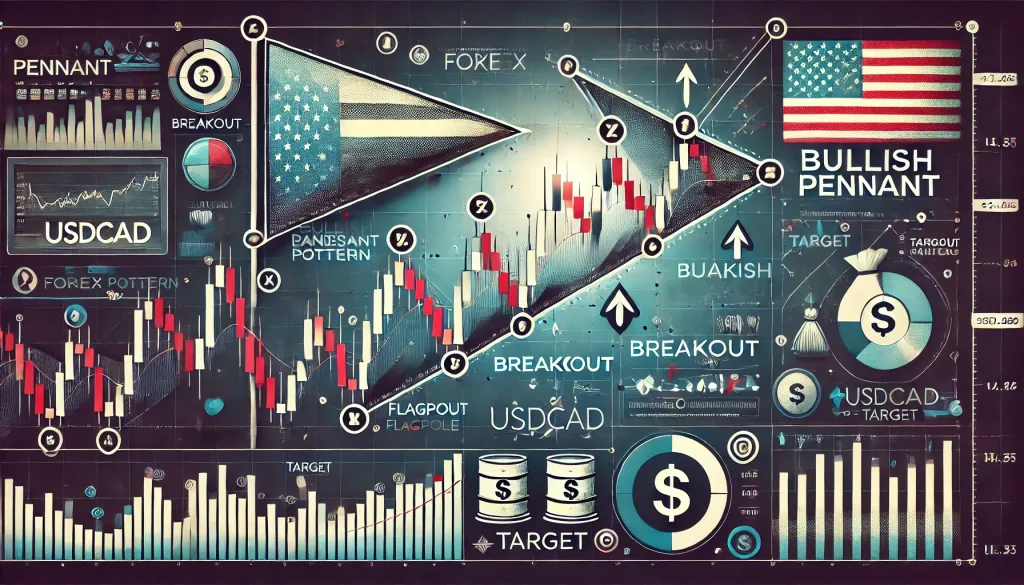

The forex market can feel like a labyrinth of candlesticks, wicks, and the occasional heart attack-inducing market spike. But if you’re trading USDCAD and spot a bullish pennant, you’re looking at a golden opportunity—if you know what you’re doing. Let’s uncover the hidden tactics and insider knowledge you need to milk this setup for everything it’s worth.

What Exactly is a Bullish Pennant, and Why Should You Care?

A bullish pennant is like the afterparty of a price breakout. It occurs when a strong upward price movement consolidates into a small, triangular pattern before resuming its upward trend. Imagine it’s like a sprinter pausing for a sip of water before bolting to the finish line. In trading terms, this is your sign to get ready for another leg up.

But why does this matter for USDCAD? Simple: this currency pair’s price movements often align with global oil prices and interest rate differentials, making it fertile ground for such patterns. Spotting a bullish pennant here can be as lucrative as discovering an uncut diamond in a pile of rocks.

The Hidden Formula Only Experts Use

Most traders recognize the pennant, but here’s where the pros take it to the next level:

- Measure the Flagpole: The height of the preceding breakout (known as the flagpole) is your target for the next move. If USDCAD breaks out of the pennant at 1.3500 and the flagpole was 100 pips, your target should be 1.3600.

- Volume Confirmation: Don’t trust a breakout without backup. Look for increasing volume as the price breaks out of the pennant—it’s like a standing ovation confirming your trade decision.

- Timeframe Matters: Pennants on higher timeframes (4H or daily) carry more weight than those on lower timeframes. Think of it as comparing a marathon to a quick jog—the bigger trend has more endurance.

Why Most Traders Get It Wrong (And How You Can Avoid It)

Here’s the kicker: many traders jump the gun, entering the trade before the breakout. Rookie mistake! This is like betting on a horse before it’s out of the stable.

Instead:

- Wait for the Breakout: Enter only when the price decisively breaks out of the pennant—ideally, 1-2% beyond the breakout level.

- Set Tight Stop-Losses: Place your stop-loss just below the pennant structure to minimize risk.

- Use Confluence: Check if the breakout aligns with key levels like Fibonacci retracements, moving averages, or pivot points. Think of it as the ultimate team-up for trading success.

Advanced Insights: The Little-Known Secrets to USDCAD Pennant Trades

- Oil Prices as a Compass: USDCAD’s movements often mirror trends in oil prices. If oil is rallying, keep an eye on a potential bullish pennant breakout.

- Interest Rate Expectations: Monitor announcements from the Federal Reserve and the Bank of Canada. Diverging rate policies can amplify the pennant’s breakout potential.

- Hidden Time Zones: USDCAD often sees heightened activity during the overlap of the London and New York trading sessions. Trading during this window increases the likelihood of a successful breakout.

Step-by-Step Game Plan for Trading the USDCAD Bullish Pennant

- Spot the Pennant: Look for a sharp price rally followed by a consolidation into a triangular pattern.

- Analyze the Context: Check fundamentals like oil prices, interest rates, and economic news to confirm your bias.

- Wait for the Breakout: Enter the trade only after a decisive breakout with increasing volume.

- Set Your Targets and Stops:

- Target: Length of the flagpole added to the breakout point.

- Stop-Loss: Below the pennant structure.

- Monitor and Adjust: Keep an eye on market conditions and adjust your stop-loss to lock in profits as the price moves in your favor.

Case Study: The USDCAD Pennant of October 2023

In October 2023, USDCAD formed a textbook bullish pennant on the 4-hour chart, consolidating at the 1.3400 level after a 150-pip rally. Following an oil price spike, the pair broke out to 1.3550, hitting the target precisely. Traders who followed the pennant strategy banked significant profits, while others missed the boat entirely.

Avoiding the Rookie Pitfalls

- Over-Leveraging: Don’t let greed cloud your judgment. Trade with a risk level of 1-2% per trade.

- Ignoring Fundamentals: A bullish pennant is great, but ignoring factors like interest rates or oil trends can turn a winning trade into a losing one.

- FOMO Entries: Fear of missing out is not a strategy. Stick to your plan and wait for confirmation.

From Insight to Action

Trading USDCAD’s bullish pennant isn’t just about spotting the pattern; it’s about executing with precision and discipline. By understanding the context, waiting for confirmation, and using advanced techniques, you’re not just trading—you’re strategizing like a pro.

Now it’s your turn. Have you spotted a bullish pennant on USDCAD? Share your insights in the comments below or join the StarseedFX community to discuss strategies and stay ahead of the curve.

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The