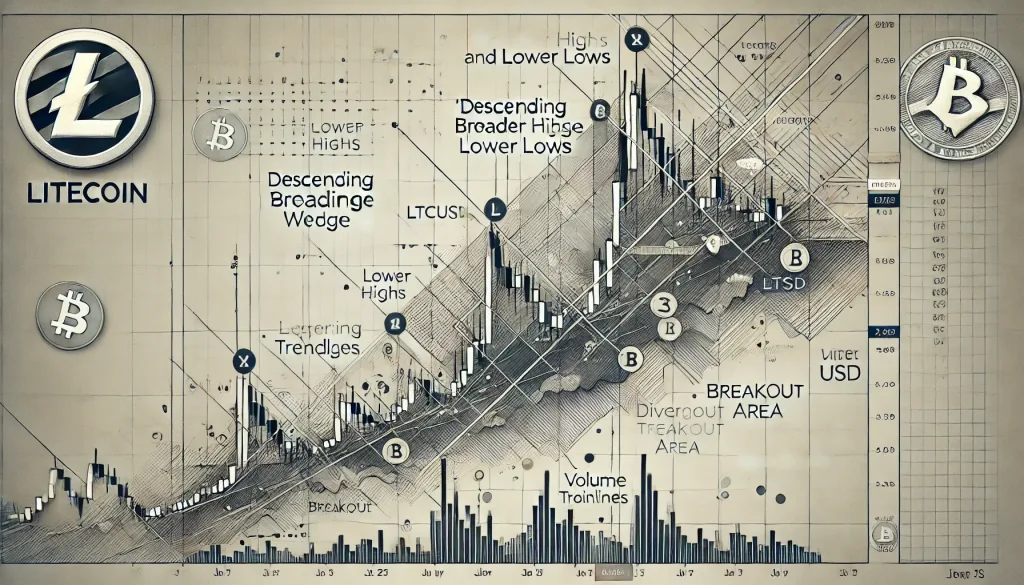

Cracking LTCUSD: Unlocking the Secrets of the Descending Broadening Wedge

Cracking the Code: LTCUSD and the Descending Broadening Wedge

Imagine trying to navigate a labyrinth with shifting walls. That’s what the cryptocurrency market often feels like, especially when you’re trading LTCUSD. But what if I told you there was a map, a hidden pattern that’s as close to a cheat code as you can get? Enter the Descending Broadening Wedge, a formation that’s your VIP ticket to understanding market reversals and seizing profits like a pro.

What’s a Descending Broadening Wedge Anyway?

Picture a megaphone turned upside down. The wedge is formed when price action creates lower highs and lower lows, but the range between these highs and lows broadens over time. It’s like watching a stressed-out slinky unraveling.

Here’s the kicker: this pattern is typically bullish. Yes, even though it slopes downward (cue confused traders everywhere), the breakout is often upward. Why? Because it signals weakening bearish momentum and the potential for the bulls to make a comeback.

Spotting the Wedge on LTCUSD

Before diving headfirst into a trade, here’s how to identify a descending broadening wedge:

- Lower Highs and Lower Lows: The price consistently forms lower peaks and troughs.

- Diverging Trendlines: Connect the highs and lows with trendlines, and you’ll see the wedge broadening over time.

- Volume Shrinkage: Volume often decreases as the pattern develops, hinting at an impending breakout.

Think of it as a dramatic build-up to a plot twist in your favorite thriller: the slower the build-up, the bigger the surprise.

Why Most Traders Miss This Hidden Gem

Most traders ignore this pattern because they’re too busy chasing the next shiny object—be it the latest meme coin or an overhyped breakout. But here’s the secret sauce: the descending broadening wedge doesn’t just hint at a reversal; it screams it. You just need to know where to look.

Consider this: Between June and September 2023, LTCUSD formed a textbook descending broadening wedge. Most traders panicked and sold, but savvy traders who recognized the pattern doubled down and reaped the rewards when prices broke upward by 18%.

Step-By-Step: How to Trade the Descending Broadening Wedge

1. Identify the Pattern

Use a reliable charting tool to spot the wedge. Platforms like TradingView allow you to easily draw trendlines and analyze volume.

2. Confirm the Breakout Direction

Wait for the price to break above the upper trendline with strong volume. False breakouts are the party crashers of trading—don’t get fooled.

3. Set Your Entry Point

Place your buy order slightly above the breakout level. This ensures you’re riding the wave once the pattern confirms.

4. Define Stop-Loss and Take-Profit Levels

- Stop-Loss: Place it below the most recent low within the wedge.

- Take-Profit: Aim for the height of the wedge added to the breakout point.

5. Monitor Your Trade

Keep an eye on volume and momentum indicators, such as RSI or MACD, to ensure the trend is sustainable.

Advanced Insights: Ninja Tactics for Mastering LTCUSD

1. Diversion Detection

Look for bullish divergence on the RSI. If the price forms lower lows, but the RSI forms higher lows, it’s a signal that the bears are losing steam faster than a New Year’s resolution.

2. Volume Is King

Pay close attention to volume spikes during the breakout. A strong breakout with little volume is like a car with no gas—it won’t go far.

3. Pair It with Fundamentals

Stay updated on Litecoin’s fundamentals. For example, a new adoption announcement or a halving event could amplify the breakout’s impact.

Avoiding Common Pitfalls

1. Jumping the Gun

Patience is a virtue. Entering before the breakout is confirmed can lead to losses. Remember, the market doesn’t reward impatience.

2. Ignoring the Big Picture

Always consider the broader market context. If the crypto market is in a strong downtrend, even a bullish wedge might struggle to deliver.

3. Forgetting Risk Management

Risk only what you can afford to lose. A solid risk-reward ratio (e.g., 1:3) is your best friend in trading.

Why LTCUSD Is Perfect for This Pattern

Litecoin’s relatively high liquidity and consistent price movements make it an ideal candidate for technical patterns like the descending broadening wedge. Plus, its correlation with Bitcoin often provides additional cues for trend reversals.

Real-Life Example: The 2023 LTCUSD Breakout

During Q2 of 2023, LTCUSD was trapped in a descending broadening wedge for six weeks. As Bitcoin stabilized and market sentiment improved, LTCUSD broke out upward, soaring from $65 to $78. Traders who recognized the pattern enjoyed a 20% gain in less than a month. Now that’s what I call turning lemons into crypto lemonade.

Key Takeaways: Your Action Plan

- Master the Pattern: Learn to identify descending broadening wedges.

- Wait for Confirmation: Always confirm breakouts with volume and momentum.

- Combine Technical and Fundamental Analysis: Use Litecoin’s fundamentals to strengthen your strategy.

- Practice Risk Management: Never trade without a stop-loss and a clear risk-reward plan.

Ready to Level Up?

If you want to stay ahead of the game and uncover more hidden opportunities like this, check out these resources:

- Latest Economic Indicators and Forex News

- Forex Education Courses

- StarseedFX Community Membership

- Free Trading Plan

- Smart Trading Tool

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The