Price Action Trading Meets the Triple Top: Mastering the Forgotten Setup

If you’ve ever experienced the stomach-dropping moment of watching your winning trade nosedive faster than a bad stock photo of a crashing plane, you’re not alone. We’ve all been there. Maybe you had too much faith in the “uptrend that’ll never end,” or maybe your trading plan was about as solid as a New Year’s resolution to quit caffeine (yeah, that lasted three days). Either way, if you’re tired of seeing your trades flop, it’s time to up your game with some price action trading mastery—specifically, the elusive and incredibly underrated triple top pattern.

The Triple Top: Your New Best Friend (Once You Understand It)

Before we dive into the advanced tactics, let me set the stage with a little empathy. Triple tops are like the guests at a party who can’t make up their mind whether they want to stay or leave. You think they’re heading for the door (the downtrend), but oh no, they turn back for one last bite of that stale cake (the resistance level). Most traders see a triple top forming and either ignore it or misinterpret it as some random fluctuation. But, here’s where the real magic happens: the triple top pattern is a powerful reversal signal.

The problem is, while everyone and their dog is busy with head and shoulders, you’re going to be diving into the ninja tactics of the triple top. Why? Because most people overlook it, which means fewer fake-outs, less competition, and more hidden opportunities for those in the know.

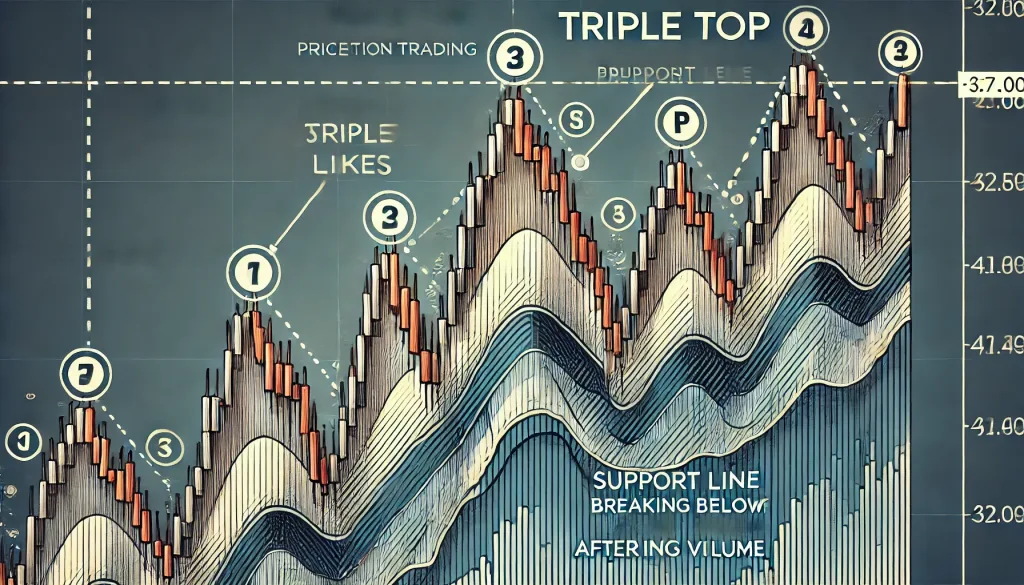

Triple Top Formation—What Exactly Is It?

Picture this: The price moves up and tests a resistance level three times, but each time it fails to break through. If the market was a high-school drama, this would be like someone trying to get into the “cool kids’ circle” but getting bounced every time. That resistance level? It’s the bouncer. The market tries, fails, and eventually says, “Okay, I’m done here,” and heads back down.

The third failure is crucial. It’s like watching a sitcom character repeatedly run into a glass door. The first time—it’s a mistake. The second time—kind of funny. But the third time? It’s deliberate, it’s telling you something: this door isn’t opening. And that, dear reader, is your cue.

Pro Tip: A triple top is only confirmed once the price breaks below the support line that’s formed between the peaks. This is like that moment when the market finally gets fed up and says, “Forget it, I’m heading in the other direction.” You’re not jumping the gun here—you’re waiting for the action, just like a savvy pro.

Advanced Ninja Tactics to Trade the Triple Top

1. Avoiding the FOMO Trap

One of the biggest mistakes traders make is falling for a false breakout after the second peak. This happens because of that sweet, intoxicating thing called FOMO—Fear Of Missing Out. But here’s a secret: The market wants you to get emotional, to panic and jump in early. Think of it like buying that pair of shoes just because they’re 70% off, only to realize they’re two sizes too small. Don’t do it.

Instead, wait for the support level to break—this confirms that the third strike really means the trend has turned against the bulls. You need discipline here. Like one of those Zen monks who doesn’t blink when someone’s swinging a sword in front of their face, stay cool, stay patient, and don’t make a move until that support is out of the way.

Insider Insight: Most traders are in a hurry to get rich—they think more trades mean more profit. But trading fewer, more accurate patterns like a confirmed triple top beats constant overtrading. Less is more, my friend.

2. The Hidden Volume Trick

Here’s a next-level secret that’s overlooked even by seasoned traders: watch the volume. Ideally, you want to see declining volume on each peak—this signals that the bulls are running out of steam, like a marathon runner gasping for air as they see the finish line but realize their legs have betrayed them.

When the volume starts dropping on each peak, you know the buyers are losing momentum. When the price finally breaks through support, you want an increase in volume to confirm that the market’s got some real juice behind it—that’s when you make your move.

Case Study: Remember the 2019 EUR/USD triple top? No? That’s because everyone was too busy hyping up the Eurozone GDP data. But those in the know spotted a declining volume pattern on the third peak, followed by a solid breakout below support. And guess what? It led to a profitable 200 pip drop in just a few days. Always keep an eye on volume—it’s like having night vision goggles when everyone else is stumbling in the dark.

3. The “Wait for the Retest” Strategy

Here’s another advanced trick that separates the pros from the amateurs: waiting for the retest. Most traders enter immediately after the break below support, which is fine if you’re into high-risk trading. But if you want to play it smart, wait for the price to retest the previous support level—which now acts as resistance. If it fails there, it’s your golden ticket to hop on board the downtrend.

This is like waiting for the dust to settle before charging into the action. It reduces your risk and increases your chances of a successful trade. Imagine being that person who watches a bar fight from the corner, waits for the chaos to subside, and then casually steps in to pick up the winning bet. That’s you, with the retest strategy.

Common Pitfalls (And How to Dodge Them Like Neo in The Matrix)

1. Ignoring Timeframes

You know what’s worse than a triple top? A triple top on the 5-minute chart that you’re trying to trade like it’s the apocalypse. One of the biggest mistakes you can make is confusing different timeframes. The larger the timeframe, the stronger the signal. A triple top on the daily chart is more like an invitation to the main event, while a 15-minute triple top might just be a pre-show warm-up band—entertaining but ultimately not the real deal.

2. Not Setting Realistic Targets

Let’s be real—a triple top isn’t going to turn into the “retire tomorrow” trade. Setting realistic targets is crucial. If you think the market will drop 500 pips just because you caught a triple top, you might as well also be expecting your Uber driver to show up on a unicorn. Keep your target modest—aim for the height of the triple top pattern. Once you hit that target, manage the rest of your position smartly.

Expert Quotes to Boost Your Strategy

John Bollinger, the guy behind Bollinger Bands, once said, “The market is a psychological mechanism, not a machine.” Understanding patterns like the triple top means understanding crowd behavior, fear, and greed. When you learn to spot these moments of indecision, you’re not just trading—you’re practically reading minds.

Linda Raschke, an expert trader, adds, “There is nothing new under the sun. Bubbles and panics, tops and bottoms, patterns—they’re all just variations of old themes.” This is what makes mastering the triple top so effective. You’re not reinventing the wheel; you’re just learning to drive it better.

Hidden Opportunities: The Triple Top in Emerging Markets

Here’s an under-the-radar tip: triple tops often form in emerging market currencies when they reach significant psychological levels. Think USD/TRY or USD/BRL when geopolitical events are on the horizon. The triple top becomes a signal that smart money is starting to back off. In these less liquid pairs, the moves can be dramatic, leading to significant profit opportunities—if you can stomach the volatility.

How to Practice Without Blowing Your Account

The best way to master this is to practice on a demo account or with a small live position. And guess what? We’ve got a Free Trading Plan you can use to set goals, manage risks, and track progress—all designed to help you grow into a smarter, savvier trader. You can find it here: Free Trading Plan. Why go in blind when you can prepare like a pro?

—————–

Image Credits: Cover image at the top is AI-generated

PLEASE NOTE: This is not trading advice. It is educational content. Markets are influenced by numerous factors, and their reactions can vary each time.

Anne Durrell & Mo

About the Author

Anne Durrell (aka Anne Abouzeid), a former teacher, has a unique talent for transforming complex Forex concepts into something easy, accessible, and even fun. With a blend of humor and in-depth market insight, Anne makes learning about Forex both enlightening and entertaining. She began her trading journey alongside her husband, Mohamed Abouzeid, and they have now been trading full-time for over 12 years.

Anne loves writing and sharing her expertise. For those new to trading, she provides a variety of free forex courses on StarseedFX. If you enjoy the content and want to support her work, consider joining The StarseedFX Community, where you will get daily market insights and trading alerts.

Share This Articles

Recent Articles

The GBP/NZD Magic Trick: How Genetic Algorithms Can Transform Your Forex Strategy

The British Pound-New Zealand Dollar: Genetic Algorithms and the Hidden Forces Shaping Currency Pairs

Chande Momentum Oscillator Hack for AUD/JPY

The Forgotten Momentum Trick That’s Quietly Dominating AUD/JPY Why Most Traders Miss the Signal

Bearish Market Hack HFT Firms Hope You’ll Never Learn

The One Bearish Market Hack High Frequency Traders Don't Want You to Know The